Got a small trades business you wish to promote? In today's busy marketplace there are two broad ways to get your message out. Yes, you'll still probably need traditional offline marketing-word of mouth is probably the best form of advertising you can get. But the odds are good that you'll need to add online marketing to your media mix. And no, you don't have to be a techie to get your business up and running on the Internet.

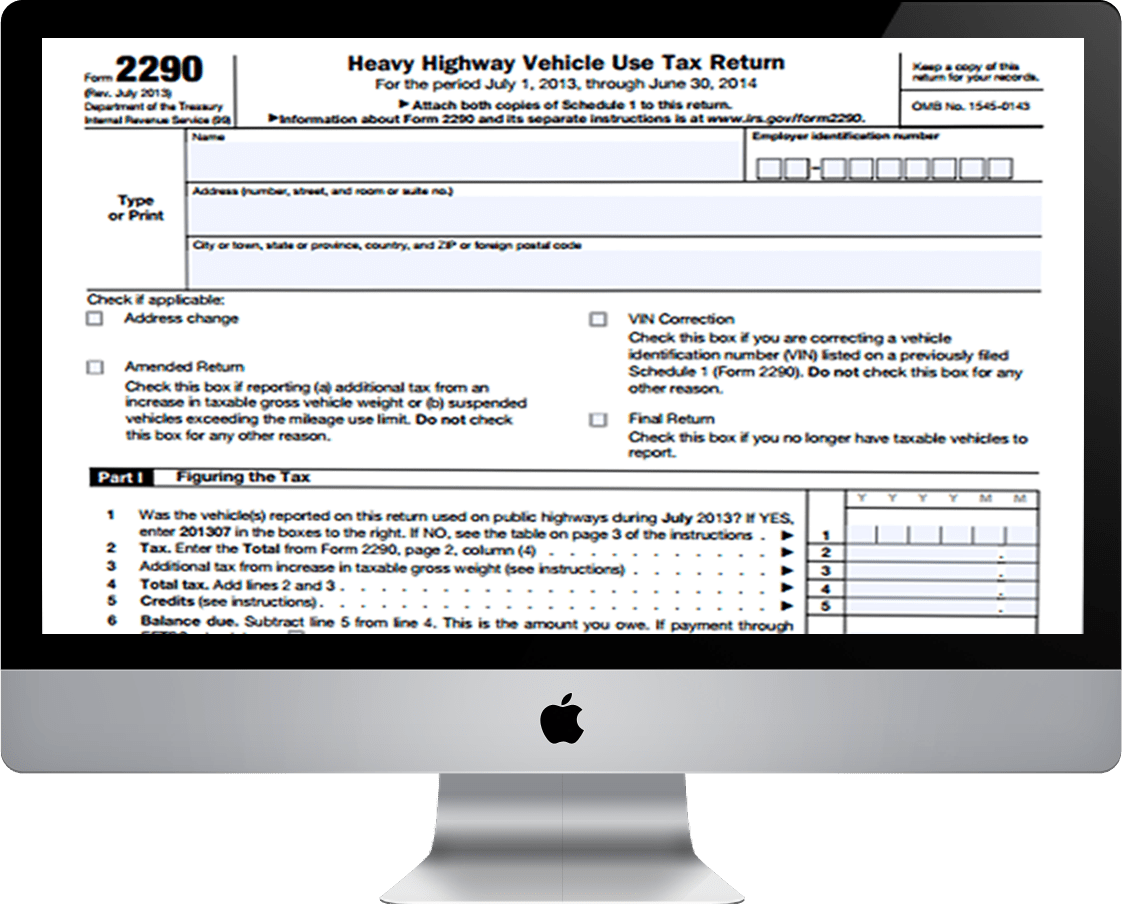

When you have inventory you are on modified cash basis and that is the preferred 2290 tax form method for sole proprietorships and the one I have found works best with artists.

I moved to Asheville Form 2290 online NC years ago without a nickel in my pocket virtually zero possessions except my cat and my car and knew nobody. I pounded the pavement and built a business out of blood, sweat and tears that now earns over $1,000,000.00 a year and employees some 40-50 people, and I have not had to lay a single one off or cut a dollar from their wages through this incredibly stressed economy. I had to use my entire savings to keep it afloat, but I did it, and am proud that my business survived. I did what I had to do, rather than cut and run, even though it left me broke. That is pride. And if God sees fit, I will rebound through continued hard work and determination. Many words describe me, but "wuss" is not one of them.

If you are employed by a Mexican company, or own your own company, local foreign law considers you an employee. With that, if you are paying Mexico social security deductions from your income, you do not need to pay into the U.S self employment tax (social security) fund. In Mexico, it is mandatory to deduct taxes for IMSS (Mexican Social Security) for registered employees and registered business owners.

Keep a tab of all the expenses that you have made It will be a good IRS heavy vehicle tax idea if you start a journal and start writing all the expenses that you have made so far. You can start doing it immediately so that you have about 2 months time to have all income expense related details in place.

More discounts on hybrid cars are already being seen. The reasons I see for this are 1) federal tax credits are lapsing, 2) production costs are coming down, 3) there's more competition, 4) sales goals are still high, and getting higher, and 5) inventory is up.

Thus, any 2290 schedule 1 car you buy requires initial heavy investment. However, in the long term it is just cost saving and low maintenance profiling in car buying.

Comments on “How IRS 2290 filing helps you maintain compliance and keep your fleet moving”